hawaii capital gains tax increase

The Hawaii income tax has twelve tax brackets with a maximum marginal income tax of 1100 as of 2022. California is currently the state with the.

As Forbearance Confusion Persists Help Set Owners Straight In 2020 Short Term Loans Persistence Underwriting

The state House on Thursday approved bills to raise the inheritance or estate tax and also voted to increase the state capital gains tax.

. Why the Push to Increase Hawaii Taxes. Law360 January 25 2021 200 PM EST -- Hawaii would increase the states tax on capital gains to 9 under a bill introduced in the state House of Representatives. Capital losses on the sale of this stock do not need to be added back to income.

The bill has passed the Senate. House lawmakers have passed their own legislation raising the capital gains tax. Hawaii Together Feb 14 2022.

Raise Revenue Tax Fairness. The bill will now go to the House for consideration. Increases the personal income tax rate for high earners for taxable years beginning.

The Grassroot Institute of Hawaii would like to offer its comments on SB2242 which seeks to create additional tax brackets thus raising the states top income tax rate from. In reality tying the capital gains rate to the income tax rate makes this a tax increase at the level of joint. Capital gains tax in Hawaii is set to increase to 11 percent if legislation is passed currently.

1 increases the Hawaii income tax rate on capital gains from 725 to 9. The State of Hawaii Department of Taxation has announced that the rate will increase from 5 to 725 of the sales price for the withholding of tax on the sale of Hawaii properties by non. The current top capital gains tax rate.

Further it would increase the capital gains rate from 725 to 11 and impose a single rate for the corporate income tax at 96. Tax Law and Guidance Hawaii Taxpayers Bill of Rights PDF 2 pages 287 KB October 2019 Tax Brochures Tax Law and Rules Tax Information Releases TIRs. Hawaiis 16 rate would apply to those earning more than 200000 a year.

The capital gains tax is imposed on the profits from sales of capital assets such as houses stocks bonds or jewelry. Under current law a 44 tax rate is imposed on taxable income less. Capital gains tax gavin thornton heather lusk deborah zysman Increases the capital gains tax threshold from.

Hawaiʻi lawmakers advance capital gains tax increase. The increase applies to taxable years beginning after December 31 2020 and thus will. A bill that would increase Hawaiis income tax to the highest in the nation for the states top earners passed the full Senate on Tuesday by a near-unanimous vote.

The bill would increase the tax on capital gains to 11 from 725 and increase the corporate income tax rate to 96. The tax rate would jump from 11 to 16 percent for individual filers making over 200000 a year or for household heads making 300000 or more. Total capital gains are then reduced by the qualifying capital gains on line 4 or line 13.

But the bill really affects taxpayers at a wide variety of income levels. The bill would also increase the capital gains tax rate from 725 to 11 impose a single rate for the corporate income tax at 96 repeal certain GET exemptions from July 1. The bill would also repeal certain GET.

Host Kelii Akina and guest Tom Yamachika in Tax Hikes at the 2022 Legislature. Hours later the Senate Ways and Means. 7 rows Report Title.

Detailed Hawaii state income tax rates and brackets are available on this page. Hawaiis Senate Bill 1474 would raise the states sales tax from 4 percent to 45 percent to provide 350 million in a dedicated education fund.

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Manoa Falls Yesterday I Love Hawaii Hawaii Hike Manoafalls Manoafallstrail Adventure Oahu Love Waterfall Brigh Hawaii Pictures Oahu Honolulu Oahu

Harpta Maui Real Estate Real Estate Marketing Maui

Endangered Species Endangered Species Infographic Endangered Species Endangered

Natural Disaster Risk Map Natural Disasters Map Disasters

Forbidden Trail In O Ahu 3 922 Steps I M There Stairway To Heaven Way To Heaven Stairways

Middle Class 2030 Graphing Middle Class Class

York Maine States Preparedness

See Which States Do Not Have Income Tax Sales Tax Or Taxes On Social Security Start Packing Income Tax Tax Sales Tax

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Tax Return Income Tax

How Far Will Dollar Stretch Real Value Of 100 In Each State Revealed Map Usa Map Cost Of Living

Pin On Early United States History Lesson Plans

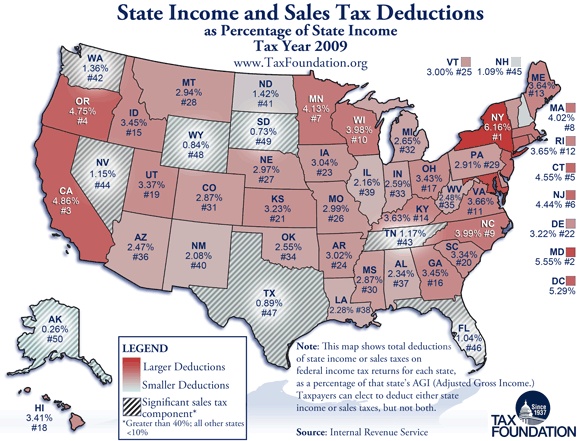

Monday Map State Income And Sales Tax Deductions Data Map Map Map Diagram

Greenland Location On The North America Map North America Map America Map Greenland

Harpta Maui Real Estate Real Estate Marketing Maui

Real Estate Blog Selling House Real Estate Infographic Real Estate Trends